Debt to income ratio how much can i borrow

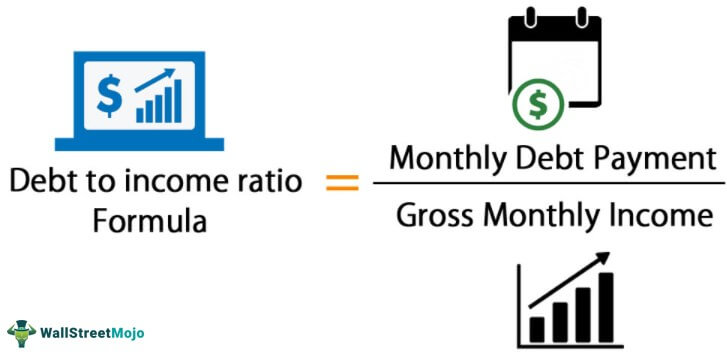

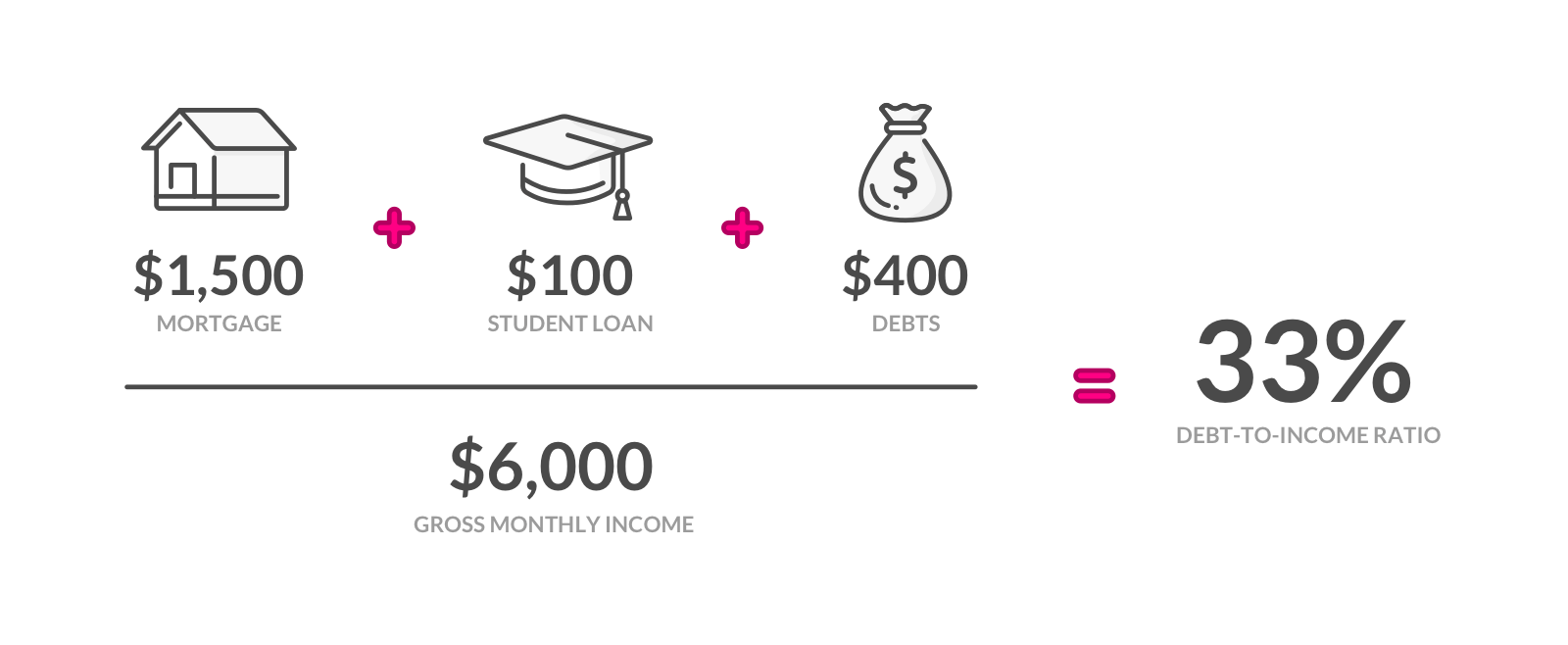

Your debt-to-income DTI ratio is your monthly gross income compared to your monthly debt payments. Or 4 times your joint income if youre applying for a mortgage.

Mortgage How Much Can You Borrow Wells Fargo

Less debt equals more borrowing power and possibly a higher loan offer.

. At 60000 thats a 120000 to 150000 mortgage. There is no maximum debt ratio. A back end debt to income ratio greater than or equal to 40 is generally viewed as an indicator you are a high risk borrower.

This may also influence your eligibility for a home equity. There is no maximum loan amount. The usual rule of thumb is that you can afford a mortgage two to 25 times your income.

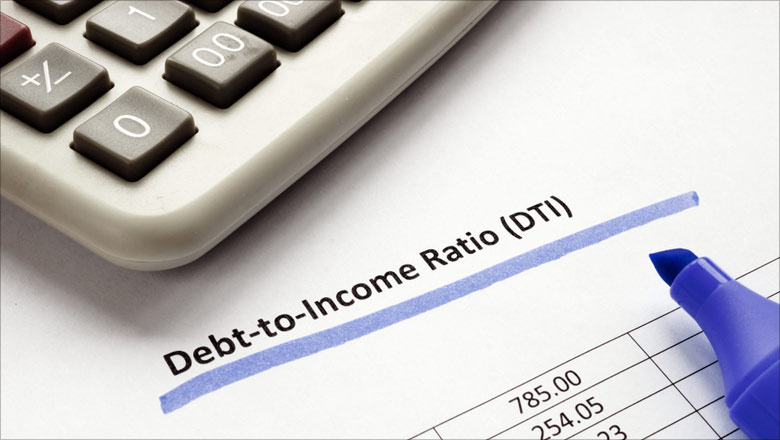

Our How much can I borrow calculator depends on an accurate input of your income and recurring debt. For a homeowner the front-end ratio can be calculated by adding up all housing expenses such as mortgage payments and insurance and dividing it by the homeowners gross income. To improve debt-to-income ratio borrowers can apply together with their spouse.

Shows what portion of your income is needed to cover all of your monthly debt obligations plus your mortgage payments and housing expenses. The debt-to-income DTI ratio is a key financial metric that lets lenders know how much of a borrowers monthly gross income goes into paying off their current debt. Find out what you can borrow.

On face value it makes sense that lenders would want to limit how much they allow you to borrow based on your income-to-debt ratio. Debt-to-income DTI ratio is the percentage of your gross monthly income that is used to pay your monthly debt and determines your borrowing risk. This includes credit card bills car.

To calculate your estimated DTI ratio simply enter your current income and payments. You can use home equity loan proceeds for home repairs college costs emergencies and more. This information can help you decide how much money you can afford to borrow for a house or a new car and it will assist you with figuring out a suitable cash amount for your down payment.

For example a consumer with a monthly gross income of 4000 who owes 1500 in monthly mortgage payments would have a front-end DTI ratio of 38 percent. You can usually borrow as much as 80 or 85 of your equity depending on a few factors. The debt ratio is defined as the ratio of total debt to total assets expressed as a decimal or.

However if your spouse has a low credit score with a record of missed payments and large credit card balances this may negatively impact your affordability assessment. Your debt-to-income ratio will go down and you may even. More Front-End Debt-to-Income DTI Ratio.

How much you can contribute to the loan Your income and. Lending must not exceed a loan to value ratio LVR of 80 for applications received from 12 November 2020 to 14 September 2021. Lenders use your DTI ratio to evaluate your current debt load and to see how much you can responsibly afford to borrow especially when it comes to mortgages.

Using this data the bank and the FHA calculate the borrowers debt-to-income ratio. How Much Mortgage Can I Afford if My Income Is 60000. VAs residual income guidelines ensure Veteran borrowers can afford the loan and determine how much money a Veteran must have left over after all debts and.

How much can that ratio be. 2836 are historical mortgage industry standers which are. Well help you understand what it means for you.

Myth 3 Banks only lend up to 70 of your DSR. A debt-to-income ratio DTI or loan to income ratio LTI is a way for banks to measure your ability to make mortgage repayments comfortably without putting you in financial hardship. This is only another rule of thumb and not particularly exact.

If the debt-to-income ratio is too high then it may be an indication that the borrower is in serious financial. FHA loan requirements include a maximum debt-to-income ratio. Bankwests borrowing power calculator helps you calculate how much you might be able to borrow for a home loan based on your income and expenses.

By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. For example if you earn.

When a borrower applies for an FHA mortgage they are required to disclose all debts open lines of credit and all possible approved sources of regular income. However the lender must provide compensating factors if the total debt ratio is more than 41 percent. Please note this calculator is for educational purposes only and is not a denial or.

Gross monthly income refers to the sum total of your monthly earnings before taxes and deductions. Maximum borrowing amounts can even differ up to 3x between different banks. The DSR is meant to show how much of a persons income is used to service debt instalments and is represented as a percentage.

Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. Note that the required debt-to-income ratio varies per lender and type of mortgage. The debt ratio is a financial ratio that measures the extent of a companys leverage.

What Is A Good Debt To Income Ratio Dti Fit My Money

Debt To Income Ratios Home Tips For Women

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How To Calculate Debt To Income Ratio

What Is Debt To Income Ratio Truliant Explains

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt To Income Dti Ratio What S Good And How To Calculate It

How To Calculate Debt To Income Ratio Credit Karma

4 Steps Every Homebuyer Should Follow When Getting A Mortgage Morty Blog

What Is Debt To Income Ratio And Why Does Dti Matter Zillow

Debt Ratio And Debt To Income Ratio

Debt To Income Ratio Formula Calculator Excel Template

How Much House Can I Afford Fidelity

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

Understanding Dti And How It Impacts Your Chances Of Getting A Loan Or Credit Card Mid Hudson Valley Federal Credit Union

Debt To Income Ratio Advance America

Debt To Income Ratios Home Tips For Women